Economic Globalization: The Real Reason for Corporate Tax Breaks

It's obvious at this point that the U.S. government isn't the one to blame for the corporations tax cuts-- the corporations themselves are. Although banks and investment firms are the most obvious targets (since they circulate the most money), large corporations of every industry has been lobbying for lower corporate taxes for the longest time.

If you think about it, the government wouldn't want to lower the taxes of companies, and especially not the taxes of large corporations and banks, as this is where the big money is at. Some conspiracy theorists attempt to show that politicians are either being paid huge bribes to support lower taxes and cuts for corporate entities, and/or have sizable investments in those companies to begin with. But all of the politicians in office put together don't have enough companies lobbying them to make up the bulk of U.S. corporations, so there's obviously a bigger force at work-- something that forces politicians to support big corporations no matter what their "special interests are"

That something is called "globalization", and it bring the capitalist plague to the corporate and government layers of things. Basically, it goes like this: "If you [the U.S. government] don't give us low taxes, we're [the corporations] going to another country to appreciates our business more." Large corporations are hitting the U.S. where it hurts-- they are threatening to leave the U.S. and go overseas, if the U.S. doesn't give them what they want. You can call it blackmail if you want, but corporations have more than enough leverage to pull it off.

The examiner has an interesting take on more recent events supporting this: http://www.examiner.com/finance-examiner-in-national/us-corporate-tax-rates-the-primary-cause-for-companies-moving-overseas

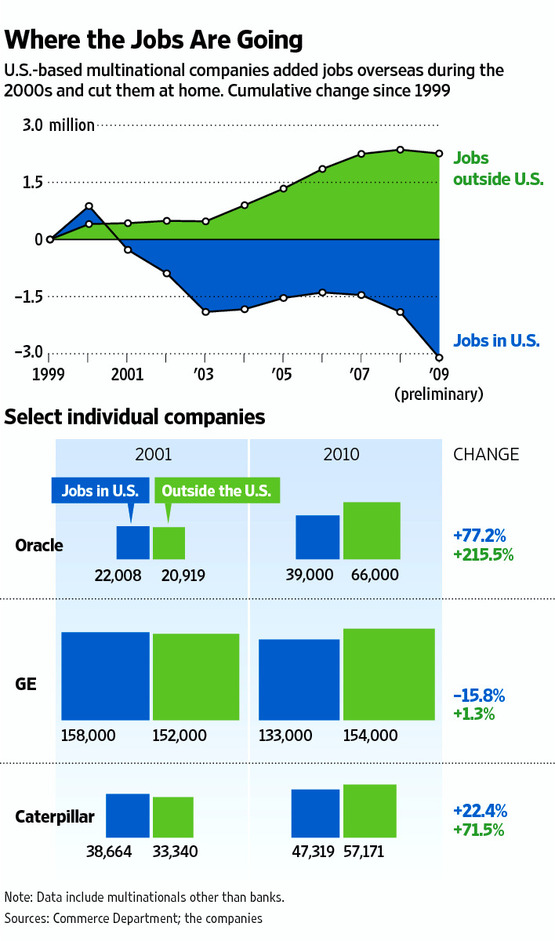

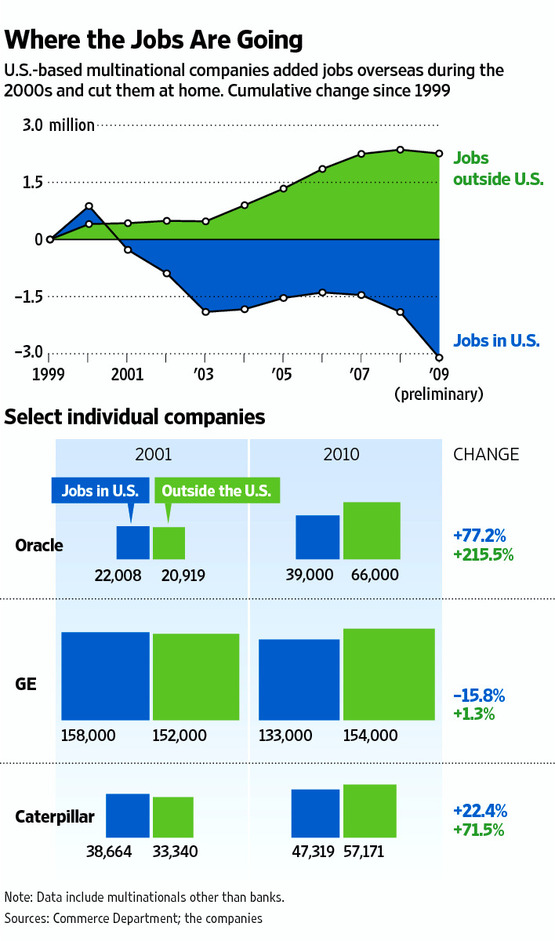

If you look at the rate of businesses leaving the U.S. to go overseas in the past 12 years, it's absolutely disgusting. (see the chart below, courtesy of wsj.com)

http://online.wsj.com/article/SB10001424052748704821704576270783611823972.html

If you compare tax breaks for corporations from the government over the same time period, you will see an increase in tax breaks for corporations that is consistently reactionary in nature. What we see here is a desperate attempt by the U.S. government to hold onto large corporations that are increasingly outsourcing their companies, and even transferring to other countries completely, to get better deals on their taxes than what the U.S. offers.

There are plenty of countries out there who are willing to offer far lower taxes than what we do-- in fact, almost all of them are, as the U.S. has the 2nd-highest corporate tax in the world. While many large corporations have indeed escaped the majority of this high tax rate, on paper they are paying this tax, and continue to levy for even more tax breaks on this premise, putting the U.S. government in a very diplomatically-weak position when it comes to tax legislation.

Sure the large corporations should be paying their dues. But due to the deadly combination of the free market and globalization, they don't have to. If the U.S. government threatens to raise taxes for corporations or close tax loopholes, the corporations will turn around and "remind" the government that they can always take their money elsewhere. So the U.S. government is given the choice of "less money", or "no money". Naturally, they take what they can get, and deal with all the political crap, because business is business.

The real problem then, is that we allowed these corporations to become this big to begin with. It's only significantly profitable for companies to outsource or have a foreign base, when corporations reach a certain critical mass. Small businesses, on the other hand, have little incentive to outsource or to move HQ to another country (due to the complications and expenses of exporting goods, not to mention the quality-of-life-in-another-country concerns). If America was more careful about preventing monopolies, and put more heavy emphasis on fostering small businesses, none of these problems would have ever happened.

So in the end, it's less about the problem of big government, and more about the threat of big money!

No comments:

Post a Comment