I'm libertarian (meaning I think the government is a necessary evil, and should be implemented to the absolute minimum necessary), so I propose that all government be localized (no Federal or State government, just municipal/county-wide governments. like each mayor is a mini-president. Sounds like the ravings of a naive political idealist, does it? Well consider the following benefits, which if such a style of government, would certainly develop as a result:

1. This would eliminate the need for a military (since there's no country, there's no political identity to defend), the country would actually be stronger owing to a far greater political diversity (instead of one government for terrorists/foreign powers/Al Kaida/ aliens from outer-space to target, they will have tens of thousands on their hands to deal with). As the economist' maxim goes, "don't put all your eggs in one basket"; our country should learn from this, and shed their identity in favor of diversity, which has already proven itself to be an evolutionarily favorable trend. Any military threats could then easily be handled by on-call volunteer militia, and local police forces.

2. Because the people's budget is controlled by more people, corruption will be minimized, as dubious budget plans and special interests agendas will be harder and harder to hide, owing to the superficiality caused by the given political diversity.

3. Because the government is smaller and more localized, the people will have far more say on the government's decisions, and the government official will most often make decisions that benefit the areas governed, because the localization ensures it (with the exception of trade agreements with other areas, government decisions would not impact the socio-economic climate of areas outside its own jurisdiction).

4. A localized government would have a comparably minimal budget, with whatever money that is taxed being spent in a way that is optimized for the people residing in that area, and in such a manner that is best suited for the predominating cultures of the given area.

5. Owing to the profound diversity of government, the outsiders (misfits, protesters, rebels, counter-culturalists, individualists, and any other people dissatisfied with the existing societies/governments) can just leave and go to another city/area that shares a greater affinity with their beliefs. Thus, greater diversity of government would largely eliminate insurrection, because the very concept of insurrection would be rendered obsolete by virtue of that diversity. Civil war, political unrest, and most other political issues would be transcended by diversity.

6. Political diversity would permit an anarchist's wet dream: To establish one's own autonomous community filled with like-minded individuals. Without the interference of federal and state government, establishing one's own autonomous region will become remarkably painless, because the lack of a federal government will result in a great deal of free land cropping up that is unaccounted for. As a result, even for those that cannot conform sufficiently to any local society or culture, they can always create their own!

Saturday, December 31, 2011

Thursday, December 22, 2011

Economic Globalization: The Real Reason for Corporate Tax Breaks

It's obvious at this point that the U.S. government isn't the one to blame for the corporations tax cuts-- the corporations themselves are. Although banks and investment firms are the most obvious targets (since they circulate the most money), large corporations of every industry has been lobbying for lower corporate taxes for the longest time.

If you think about it, the government wouldn't want to lower the taxes of companies, and especially not the taxes of large corporations and banks, as this is where the big money is at. Some conspiracy theorists attempt to show that politicians are either being paid huge bribes to support lower taxes and cuts for corporate entities, and/or have sizable investments in those companies to begin with. But all of the politicians in office put together don't have enough companies lobbying them to make up the bulk of U.S. corporations, so there's obviously a bigger force at work-- something that forces politicians to support big corporations no matter what their "special interests are"

That something is called "globalization", and it bring the capitalist plague to the corporate and government layers of things. Basically, it goes like this: "If you [the U.S. government] don't give us low taxes, we're [the corporations] going to another country to appreciates our business more." Large corporations are hitting the U.S. where it hurts-- they are threatening to leave the U.S. and go overseas, if the U.S. doesn't give them what they want. You can call it blackmail if you want, but corporations have more than enough leverage to pull it off.

The examiner has an interesting take on more recent events supporting this: http://www.examiner.com/finance-examiner-in-national/us-corporate-tax-rates-the-primary-cause-for-companies-moving-overseas

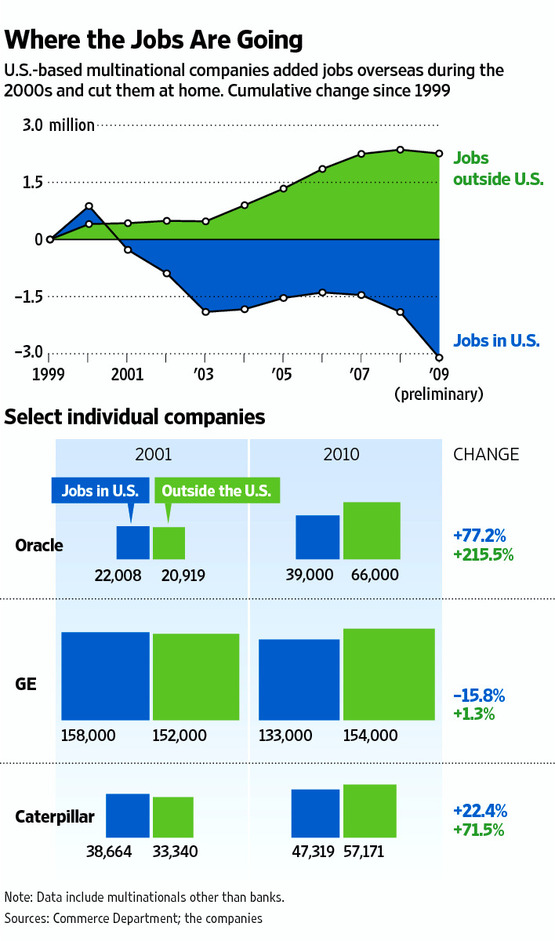

If you look at the rate of businesses leaving the U.S. to go overseas in the past 12 years, it's absolutely disgusting. (see the chart below, courtesy of wsj.com)

http://online.wsj.com/article/SB10001424052748704821704576270783611823972.html

If you compare tax breaks for corporations from the government over the same time period, you will see an increase in tax breaks for corporations that is consistently reactionary in nature. What we see here is a desperate attempt by the U.S. government to hold onto large corporations that are increasingly outsourcing their companies, and even transferring to other countries completely, to get better deals on their taxes than what the U.S. offers.

There are plenty of countries out there who are willing to offer far lower taxes than what we do-- in fact, almost all of them are, as the U.S. has the 2nd-highest corporate tax in the world. While many large corporations have indeed escaped the majority of this high tax rate, on paper they are paying this tax, and continue to levy for even more tax breaks on this premise, putting the U.S. government in a very diplomatically-weak position when it comes to tax legislation.

Sure the large corporations should be paying their dues. But due to the deadly combination of the free market and globalization, they don't have to. If the U.S. government threatens to raise taxes for corporations or close tax loopholes, the corporations will turn around and "remind" the government that they can always take their money elsewhere. So the U.S. government is given the choice of "less money", or "no money". Naturally, they take what they can get, and deal with all the political crap, because business is business.

The real problem then, is that we allowed these corporations to become this big to begin with. It's only significantly profitable for companies to outsource or have a foreign base, when corporations reach a certain critical mass. Small businesses, on the other hand, have little incentive to outsource or to move HQ to another country (due to the complications and expenses of exporting goods, not to mention the quality-of-life-in-another-country concerns). If America was more careful about preventing monopolies, and put more heavy emphasis on fostering small businesses, none of these problems would have ever happened.

So in the end, it's less about the problem of big government, and more about the threat of big money!

Labels:

big money,

blackmail,

capitalism,

competition,

corporate,

cuts,

game theory,

globalism,

investments,

lobbying,

office,

outsourcing,

political,

politics,

tax breaks,

tax rates,

taxes,

threats,

U.S.

Subscribe to:

Comments (Atom)